Accounting Degree, Requirements, Tuition Cost, Jobs and Salary

About Accounting

What is Accounting?

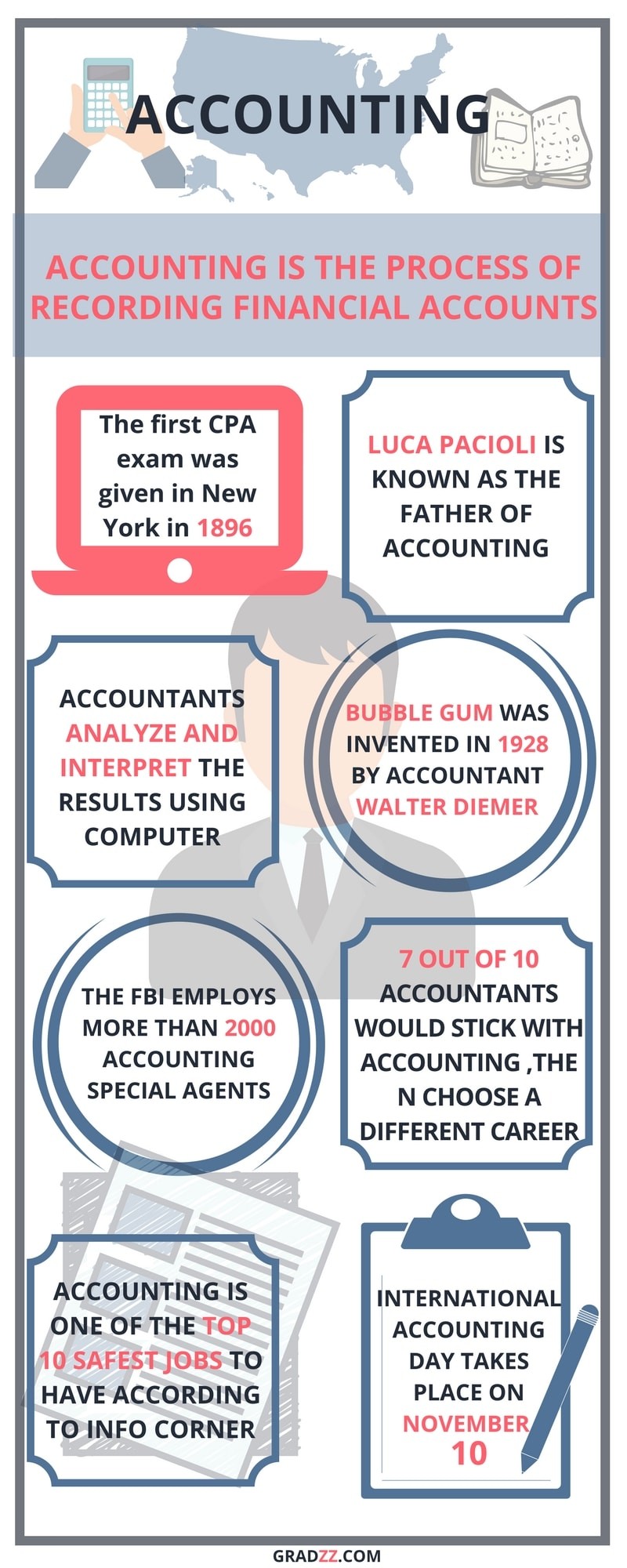

It is a proper process of identifying, recording, measuring, verifying, summarizing, interpreting and communicating financial data.

-

Accounting can be a type of language which communicates a business entity and the financial health of an organization.

-

It assesses the cash flows, investments, liabilities and predicts the future of that organization.

Accounting is the prominent Practice and knowledge concerned strongly with ways of recording transactions, Storing financial records, doing internal audits, reporting the documents and analyzing financial data to the management, and

advising on taxation matters and issues. Accounting is also called as book-keeping, it has a standard set of accounting principles.

It gives an approach to different types of business. In this way, there is kind unity in all business accounting procedures to mainly ensure that there are unity and a clear understanding no matter what business is being monitored correctly and perfectly.

Online Education in Accounting

-

Online courses in us offer us with associates, bachelors, masters and doctorate degrees.

-

Universities have a flexible curriculum for distant learning students.

-

If a student wants to work as well as study then Online education is the best.

-

You can acquire various inter-personal and transferrable skills.

-

It gives you the flexibility of time and you can study whenever you want because you can interact with the teachers in a one-to-one manner.

-

Based on your credits and marks universities offer you internships and scholarships.

Why study Accounting?

-

Almost 2 million people in the U.S. work in Accounting and Bookkeeping!

-

Accounting has proven to be one of the most secure jobs throughout a number of different industries.

-

Enjoy job security and advancement.

-

Start your own business.

-

Work from home or in a workplace setting.

Specializations in Accounting

-

Financial Accounting: Involves recordings and classifying transactions; To prepare and present financial statements used by internal and external users.

-

Managerial Accounting: Involves helping users within the management for the pursuit of organizational goals.

-

Cost Accounting: It mostly refers to recording, presentation, and analysis of manufacturing costs considered to be the subset of managerial accounting.

-

Auditing: Has two types in it:

-

External auditing: Auditors performs exams on the entire financial records of the company and give the final report.

-

Internal auditing: Focuses on evaluating the adequacy of a company's internal control structure.

-

Forensic Accounting: Popular trends in Accounting. It includes court and prosecution cases, cases and question determination, and different regions which include legitimate issues.

Career opportunities in Accounting

On the term of choosing your college major, “Don’t know what is the right step?” , “Whether the particular major will be right for you or not?”. If these questions rose in your mind, then you’re amongst the most normal students around your age.

Questioning your decisions is the best way to know whether you are choosing the right path or not. All the students thinking of pursuing an accounting degree, read the blog and maybe you find all the answers you need.

So, all the people who have a good sense of numbers and are fascinated by the flow of money, then choosing an accounting degree is the right decision for you.

Where can you work?

-

Accountants and Auditors

-

Accountants evaluate financial records to ensure their client or company is compliant with tax laws and regulations, while auditors are specialized accountants trained to find errors, discrepancies and others in financial records.

-

These professionals typically work long hours.

-

Management Analysts

-

Management analysts work with companies and organizations to boost productivity, increase profits and maintain an efficient structure.

-

Firstly they research the company’s financial history, and will often interview or survey employees to get a better understanding of how they work.

-

Once the research is complete, analysts will deliver their findings to top executives.

-

Appraisers and Assessors of Real Estate

-

These professionals inspect, evaluate and calculate the value of houses, offices, rental units, public buildings and other types of property.

-

Their findings influence how properties are bought, sold, mortgaged, taxed and insured.

-

Budget Analysts

-

Budget analysts specialize in evaluating and managing organizations with large budgets and sizable financial wealth.

-

They write and review budget proposals, and then work with organizational personnel to ensure these proposals are carried out efficiently.

Accounting Careers

Different occupations are available after graduation from an accounting degree program, some of them are listed below-

Certified Public Accountant

Certified public accountant (CPA) is the job most people with an accounting degree joins.

Their main responsibilities often consist of preparing financial records, assessing record accuracy, and ensuring that taxes are paid properly.

The average annual salary for a CPA was around $73,110 in 2016.

Actuary

An actuary is a business proficient who reduce the money related risks through probability, statistics, and information on business and financial matters.

They utilize predictive analysis of statistics and patterns to tell the probability of an event happening. It is somebody who endeavors to value the future.

The average annual salary for an actuary was around $150,189 in 2016.

Financial Analyst

Financial Analysts use data to determine to determine the potential risk and benefits of investments, helping their company or client making informed financial choices.

They prepare reports and make recommendations based on analyzed data and market trends on whether clients should engage in purchasing or selling an investment holding.

The average salary of Financial Analyst was around $113,085 in 2016.

Personal Financial Advisor

Financial Advisor help individuals and families choose investments, set up retirement accounts and navigate their finances in major life changes.

Advisors will guide by looking at the current market trends and advise to make investments in the proper basket of investments.

The average yearly wage for Personal financial advisors was $133,515 in 2016.

Forensic Accountant

The work of a forensic accountant is to continuously audit the transactions of concern, whether governmental or non-governmental, to verify frauds, transactions, liabilities, and taxation.

Main responsibility is to determine if a company or person falsifies their bookkeeping, provides evidence for court cases, produces calculations for insurance companies to determine amounts owed, and computes estate tax valuations.

Financial Manager

They develop and monitor departmental budgets to make financial forecasts for their company.

Financial managers can participate in creating financial reports, directing investments, coordinating staff activities, cultivating relationships with clients, evaluating data, and developing strategies to achieve organizational goals.

The average salary for a Financial Manager was $102,050 in 2016.

Cost Estimator

Cost Estimator uses accounting, mathematics and engineering knowledge to analyze how much a construction or manufacturing project will cost.

To become a cost estimator, you have to get a bachelor’s degree in accounting with a double major in an area like engineering, construction management, public policy, or something similar.

The average salary for a Cost Estimator was $68,444 in 2016.

Conclusion

In this article we talk about Accounting- it’s importance as a career, job opportunities and much more. A career in Accounting has more opportunities and growth in jobs than any other. It offers us you exciting and new roles in an organization. If you consider this as a career option, then you have to pursue it.

Types of Accounting

Finance

Finance, a French word meaning “the management of money.” is a study of investments.

Finance is one of the fundamentals in the business discipline that is concerned with managing money efficiently.

Four of many important fields in which you can be specialized in finance are as follows:

- Consumer finance

- Corporate finance

- Nonprofit finance

- Public finance

Finance has now become a backbone of the economic activities with the responsibilities of predicting and analyzing the potential growth for profit.

On studying finance, can benefit you from a stronger understanding of surface-level processes related to business management and adapt to the environment depending on business decisions.

Top University Offering Finance

Golden Gate University (GGU)

536 Mission Street, San Francisco, California 94105-2968

Rowan Cabarrus Community College (RCCC)

1333 Jake Alexander Blvd. Salisbury, NC 28145-1595 United States

San Antonio College

1819 N. Main Ave. , San Antonio, Texas 78212-3941

Haywood Community College

185 Freedlander Drive, Clyde, NC 28721 United States

Bluegrass Community And Technical College

470 Cooper Drive, Lexington, Kentucky 40506

Coastline Community College

11460 Warner Ave., Fountain Valley, California 92708-2597

Kansas State University

919 Mid-Campus Drive, Anderson Hall, Manhattan, Kansas 66506

University of Minnesota - Crookston (UMC)

2900 University Ave, Crookston, Minnesota 56716-5001

Degrees offered in Finance

Top University Offering

Santa Rosa Junior College (SRJC)

1501 Mendocino Avenue, Santa Rosa, California 95401-4395

Colorado State University - Global Campus

7800 East Orchard Road, Suite 200 Greenwood Village, CO 80111

Tarrant County College District

1500 Houston St, Fort Worth, Texas - 76102-6524

New River Community College (NRCC)

5251 College Drive, Dublin, Virginia 24084-1127

Wake Technical Community College

9101 Fayetteville Road, Raleigh, North Carolina - 27603-5696

Cuyahoga Community College (TRI-C)

700 Carnegie Ave, Cleveland, Ohio 44115-2878

Wilson Community College

902 Herring Avenue Wilson, NC 27893-3310 United States

Oconee Fall Line Technical College (OFTC)

1189 Deepstep Rd, Sandersville, Georgia - 31082

Forensic Science

Know More about Forensic Science

Top University Offering Forensic Science

Southern New Hampshire University (SNHU)

2500 North River Road, Manchester, New Hampshire 03106-1045

Houston Community College

3100 Main Street, Houston, Texas 77002

Franklin University

201 S. Grant Ave. Columbus, OH 43215-5399 United States

Bay Path University

588 Longmeadow Street, Longmeadow, Massachusetts 01106

Colorado State University - Global Campus

7800 East Orchard Road, Suite 200 Greenwood Village, CO 80111

Independence University

4021 S 700 E Ste 400, Salt Lake City, Utah 84107

Lakeland University

W3718 South Drive Plymouth, WI 53073-4878

Stevenson University

1525 Greenspring Valley Rd, Stevenson, Maryland 21153-0641

Degrees offered in Forensic Science

Average Tuition and Cost for Accounting Degrees

| Degree type | Total Tuition | Tuition Per Credit |

|---|---|---|

| Bachelors | $ 50144 | $ 433 |

| Associate | $ 14792 | $ 223 |

| Masters | $ 27038 | $ 752 |

| Doctorate | $ 59826 | $ 706 |

Degrees offered in Accounting Degrees

Accreditation for Accounting

Colleges Offering Accounting Programs and Degrees

Colorado State University - Global Campus

7800 East Orchard Road, Suite 200 Greenwood Village, CO 80111

Central Carolina Community College (CCCC)

1105 Kelly Drive, Sanford, NC 27330 United States

Golden Gate University (GGU)

536 Mission Street, San Francisco, California 94105-2968

Santa Rosa Junior College (SRJC)

1501 Mendocino Avenue, Santa Rosa, California 95401-4395

Tarrant County College District

1500 Houston St, Fort Worth, Texas - 76102-6524

Wilson Community College

902 Herring Avenue Wilson, NC 27893-3310 United States

Cuyahoga Community College (TRI-C)

700 Carnegie Ave, Cleveland, Ohio 44115-2878

Southern New Hampshire University (SNHU)

2500 North River Road, Manchester, New Hampshire 03106-1045

Broward College

225 E las Olas Blvd Fort Lauderdale, FL 33301