EdvestinU Reviews 2020

Edvestinu Is a non-profit lender and refinancer which sets itself apart from other lenders with low-interest rates. Find out if they are the best for you.

Updated by Jason Joy Manoj on 10th November 2021

If you are planning to take a loan from a private institution then you will have to choose from the big banks, credit unions, and non-profit lenders. EdvestinU is a non-profit loan program lender offered by theNew Hampshire Higher Education Loan Corporation (NHHELCO) which provides a low-cost variable rate.

It is available to the students who are in and out of state and there is also a provision for international students studying in the US.

This article will cover everything you need to know about EdvestinU student loans and refinancing option available for students.

Table of contents

EdvestinU Reviews

Now you know what EdvestnU has to offer but is it worth choosing EdvestinU? Here is our verdict on the non-profit loan program offered by the New Hampshire Higher Education Loan Corporation.

Rates

If you are a resident of New Hampshire studying in or out of state or if you are a student from any other state in the US studying in New Hampshire then you have the best rates reserved for you. You can avail of a 0.5% APR reduction if you enroll for autopay.

EdvestinU has attractive rates(both fixed and variable) to offer and are worth looking at for a borrower but it is important to note the difference between a fixed and variable rate before taking a decision.

Payment options

-

If you wish to start paying off your loans sooner than the scheduled dates but cannot afford to make payments towards the principal amount then you can start making interest-only payments with EdvestinU.

-

There are also deferred plans available with EdvestinU, but these plans along with the Interest-only payment options have comparatively higher interest rates resulting in higher interest payments over the term of the loan.

-

EdvestinU has penalty-free repayments where a borrower can pay off sooner without any additional costs to be made. This is what makes EdvestnU an attractive choice for borrowers, you need to have several options to go about your repayment journey. The only downside is that the rates are higher for interest-only and deferred payment plans.

Struggling with payment

-

If you are finding it hard to make the monthly payments and are planning to consolidate your loans then EdvestinU can help consolidate your loans with terms ranging from 15 to 20 years. Another feature that makes EdvestinU stand out is that they provide this consolidation option with a penalty-free repayment. And you can choose between fixed and variable rates.

-

The future is inevitable and one should be prepared for all kinds of situations to come up, it is important to go for a lender who can provide you with options when you struggle to meet your payments, EdvestinU fulfills that need to help their borrowers in times of difficulty.

-

With no extra fees, these loans are attractive and are very beneficial for students. The downside is that the approval rate for these loans is quite high. You must always remember to try and exhaust all-expense coverage using federal loans and anything left outstanding should be covered using private loans. Keep comparing to try and figure out which is the best loan for you.

Advantages and disadvantages of EdvestinU Student Loans

The pros and cons you must consider before borrowing loans from EdvestinU Student Loans:

Advantages

-

Refinancing is possible without a degree.

-

There is an option for the borrowers to make payments while studying in school.

-

No application, prepayment fees applicable.

Disadvantages

-

The credit score required is 800.

-

Though they include deferment and forbearance options it is evaluated on a case-by-case basis.

-

Does not allow refinance loan balance above 200000 dollars.

EdvestinU Student Loans

Getting into the right college is a tribulation in itself but once you get there each step comes with a cost. And these costs add up not just in amount but as a burden to the students. EdvestinU aims to ease this burden by providing Loans( for both graduate and undergraduate ), refinancing options, and scholarships. We shall study in detail about the loans provided by the EdvestinU.

Eligibility to get EdvestinU Student Loans

-

Loans available for dependent and independent U.S. citizen and permanent resident undergraduate and graduate students.

-

An international student must have a US citizen as a cosigner who is creditworthy.

-

Enrollment for half time for a degree-granting college or university.

-

Student/cosigner must have a minimum income of $30,000.

Amount

The amount you can borrow as a loan is at a minimum of $1,000 and an aggregate maximum of $200,000. However, the amount you borrow will only cover the tuition costs and not the non-tuition costs.

EdvestinU features you should be aware of

-

Variable APR from 4.446% - 10.440%

-

Fixed APR from 4.516% - 9.260%

-

Zero fees and flexible repayment option

-

Co-signer release available

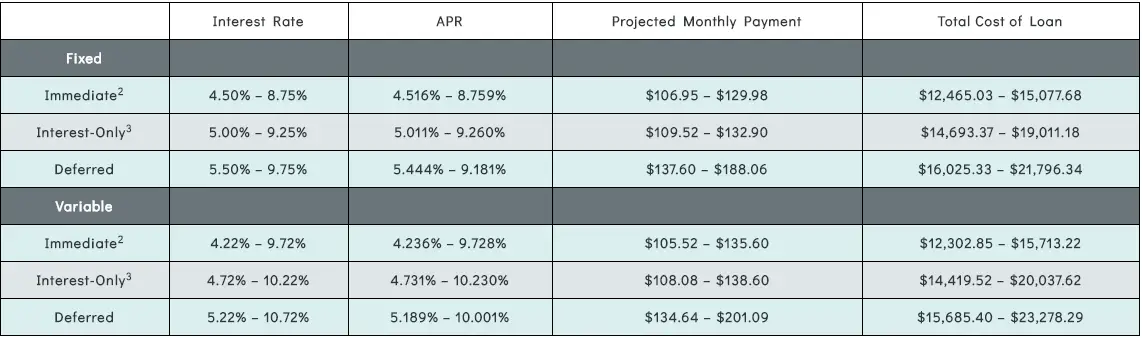

The following table should give you an in-depth idea of what to expect with EdvestinU

| Features of EdvestinU Student Loan | |

| Loan amount | Minimum of $1,000 and an aggregate maximum of $200,000 |

| Loan terms | 7,10,12,15,20 years |

| Fees | No fees charged |

| Discounts | 0.5% autopay discount |

| Citizenship | The borrower must be a US resident or citizen |

| Income | The borrower must have an income of at least $30,000 or must have a cosigner |

| Enrollment | A student must be admitted to or enrolled at least half time at any title IV degree-granting college/university |

| Repayment | Full deferment, interest-only payments, principal and interest payments |

| Cosigner info | After 24 months of on-time payments, the co-signer can be released |

| Loan servicer | Granite State Management & Resources |

It is important to note that while in college your expenses wouldn’t only be towards tuition but also for other things like food, books, rent, and more. Because of the attractive lower rates offered by EdvestinU, it is worth considering them as a lender.

While considering taking up a student loan it is always important to compare the rates and other important features before going ahead with a lender. The best rates offered by EdvestinU are reserved for the candidates who are -

-

New Hampshire residents who are either studying in or out of the state

-

US students who choose to study in New Hampshire

International students

International students who are interested in getting a student loan must get a creditworthy cosigner who is either a US citizen or a permanent resident.

Rates

The only way to know if its the right rate is to compare rates. APR or the Annual Percentage Rate offered by EdvestinU varies whether the borrower is an international applicant or a US citizen.

Rates for Undergraduate, Graduate and International Students-

Types of Repayment Plans offered

-

Immediate - This is a low-cost alternative to the Parent PLUS loan and is ideal for working graduates and undergraduate students who are looking to save while funding their higher education expenses.

-

Interest Only - This repayment option allows students ways to minimize interest expenses after college, in an affordable manner. This plan allows parents to contribute towards the costs of college without the commitment of monthly principal payments.

-

Deferred - This repayment option provides the largest flexibility and helps borrowers reduce the overall cost of the loan by allowing for additional payments when you have extra cash, there is no penalty for prepaying.

Autopay

EdvestinU allows borrowers to be eligible for a 0.50% point interest rate reduction on their loan by allowing automatic payments from the borrower's savings or checking account.

This authorization provided by the borrower will not allow any reduction in the amount being paid each month but will reduce the finance charge thereby lowering the total cost of the loan.

Worried about college fees? Learn about student loans

EdvestinU student loan refinancing

If you already have student loans and are looking to reduce your monthly payments, reduce your interest rate, or looking to reduce both then refinancing would be the best option for you.

EdvestinU provides refinancing for both federal and private loans.

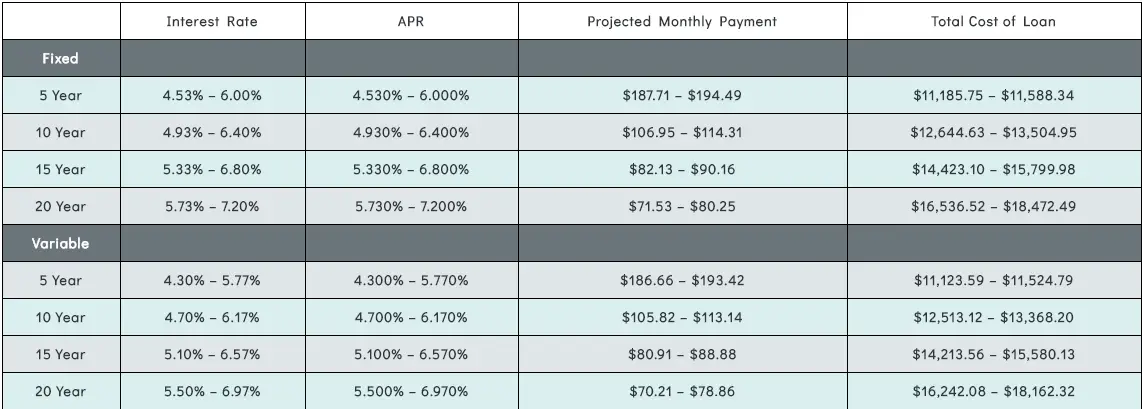

It should be noted that when you refinance a federal loan you lose certain benefits like eligibility for loan forgiveness programs. You can choose between a 5,10,15 or 20-year term and you can also prepay without any fees. You can refinance a private, federal, PLUS, or combine multiple loans into a single loan.

Refinancing with EdvestinU at a glance

-

Variable APR from 4.510% - 7.180%

-

Fixed APR from 4.530% - 7.200%

-

Zero fees with a flexible repayment option

-

Co-signer release available

With the help of the table mentioned below, you can get a comparative study of the various rates and payments associated with different loan terms -

As shown on the table the values for APR, interest rate, amount, and monthly payment are spread out between a range as it is different for each borrower.

Is refinancing right for me?

Refinancing is a good option only if it suits best for an individual's current financial situation. You can choose to refinance a loan for several reasons like releasing a cosigner or refinance multiple fixed or variable loans into a single loan with a single payment to be met each month.

Here are a few points to consider if refinancing is the best option for you -

-

Reducing a monthly payment - If you seek to reduce the monthly payments to make it more manageable you will have to lower the interest rate or extend the repayment term. However, it should be noted that on extending your repayment term, the total cost of the loan will increase.

-

Federal consolidation vs refinancing with EdvestinU - Federal consolidation allows borrowers to consolidate multiple federal loans into one and still maintain the potential federal benefits. The new interest rate will be the weighted average of the interest rates of the loans being consolidated. But EdvestinU allows you to consolidate not just federal loans but federal and private loans together.

Points a borrower should consider while refinancing with EdvestinU

-

Any remaining grace period on federal or private student loans may be fortified

-

Any potential option of income-driven repayment on their federal loans is fortified

-

Any borrower benefits associated with their federal and/or private loans are fortified

Learn more on private student loans

How to reach EdvestinU Student Loans

For further inquiries: EDvestinU can be contacted via

-

Phone: 855-887-5430

-

Fax: 6032275431

-

Address: 4 Barrell Court, Concord, NH 03301

-

Email: educationresources@edvestinu.com <educationresources@edvestinu.com>;

93.jpg)

28.jpg)